What’s new?

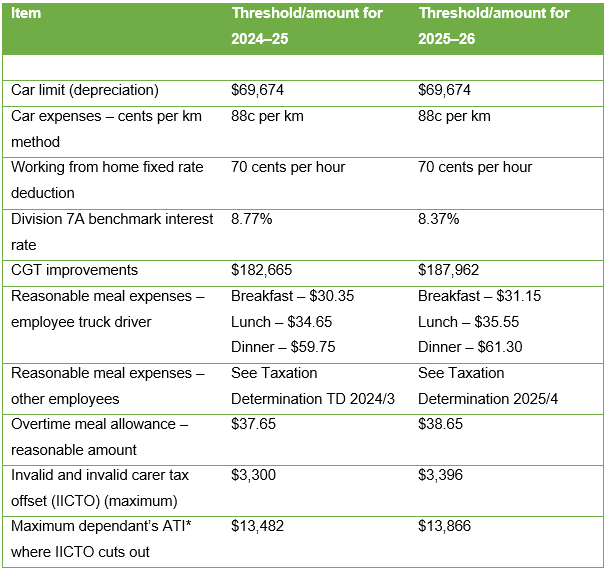

Income tax thresholds/amounts

Some income tax thresholds and amounts changed on 1 July 2025, while others did not. Some of the more common thresholds and amounts are listed below.

* ATI = adjustable taxable income

GDP adjustment for 2025–26

The GST and PAYG instalment amounts are usually adjusted every year by the ‘GDP adjustment factor’.

For the 2025–26 income year, the GDP adjustment factor is 4%. It was 6% for 2024–25.

Instant asset write-off

Are you a sole trader? The instant asset write-off (IAWO) allows a small business (aggregated annual turnover of less than $10 million) to claim an immediate deduction for the cost of eligible depreciating assets that cost less than the applicable threshold. The IAWO threshold was $20,000 for 2023-24 and 2024-25, and has reverted to $1,000 from 1 July 2025. The Government has proposed to temporarily increase the threshold to $20,000 for 2025–26 but this measure is not yet law.

The $1,000 threshold applies where a depreciating asset is first used, or first installed ready for use, on or after 1 July 2025 (even if acquired before that date).

The $1,000 threshold also applies to the ‘second element’ costs incurred on or after 1 July 2025 (including in respect of an asset that was first used, or installed ready for use, before 1 July 2025). ‘Second element’ costs are essentially costs incurred after the asset is acquired that bring the asset to its present condition (e.g. the cost of post-acquisition modifications) and location (e.g. transport costs).

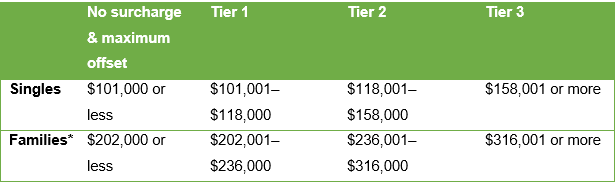

Medicare levy surcharge and private health insurance

The income thresholds for Medicare levy surcharge and private health insurance tax offset purposes are set out in the table below.

* The family income threshold is increased by $1,500 for each dependent child after the first child.

The Medicare levy surcharge is 1% for Tier 1 taxpayers, 1.25% for Tier 2 taxpayers and 1.5% for Tier 3 taxpayers.

The private health insurance tax offset percentage is highest for Tier 1 taxpayers and lowest for Tier 3 taxpayers. The percentage also varies depending on the ages of the persons covered by the relevant health insurance policy. There are 3 age brackets: under age 65, age 65 to 69, and age 70 and above.

HELP and other student debts

Do you have a study or training debt, such as a Higher Education Loan Program (HELP) debt (this used to be called a HECS debt)? The good news is that your debt has been reduced by 20% and the minimum compulsory repayment threshold has increased to $67,000 for the 2025–26 income year. In addition, the repayment rates have been simplified.

The 20% debt reduction applies to all study and training loans that existed on 1 June 2025. The ATO will apply this reduction to your loan debt on 1 June 2025; the 2025 indexation is then adjusted to the lower loan amount.

The ATO will notify you when it has applied the reduction to your study loan account.

Because of the gap from 1 June 2025 to when the reduction is applied, some of you may have paid off some, or all, of your loans. If you have a credit after the 20% reduction, you may get a refund if you don’t have outstanding tax or other government debts.

Refunds will be sent to the bank account details the ATO has for you (this could be your tax adviser’s trust account). Check to see if your financial institution account details the ATO has for you need to be updated.

The repayment thresholds and rates for the 2025–26 income year are set out in the table on the next page.

Note that the repayment thresholds and rates also apply to VET Student Loan (VSL), Student Financial Supplement Scheme (SFSS), Student Start-up Loan (SSL), ABSTUDY Student Start-up Loan (ABSTUDY SSL) and Trade Support Loan (TSL) debts.

The repayment rate is based on what is called ‘HELP repayment income’. This is effectively the sum of your taxable income, exempt foreign employment income, total reportable fringe benefit amounts, reportable super contributions and total net investment losses.

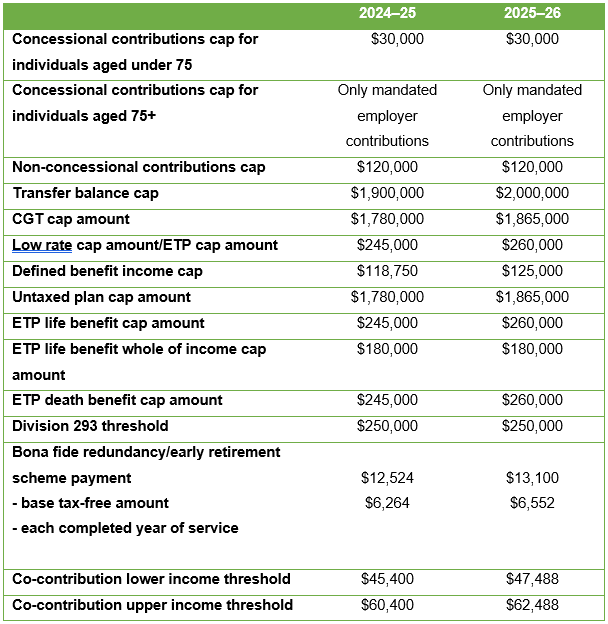

Superannuation and ETP thresholds

Relevant superannuation and ETP (employment termination payment) thresholds for the 2025–26 income year are listed below.

Note:

- To deduct a personal superannuation contribution, an individual aged 67–75 must be ‘gainfully employed’ for at least 40 hours in any 30-day period in the income year.

- If you accessed your superannuation early in response to the COVID-19 pandemic, you can choose to re-contribute those amounts by 30 June 2030 without them being counted towards your non-concessional contributions cap. The choice must be made in the approved form and given to your superannuation fund before you make the re-contribution.

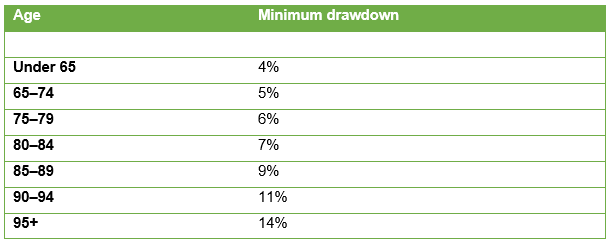

Pensions and annuities – minimum drawdown amounts

The minimum drawdown amounts for 2025–26 are set out in the table below.

If you receive more than the minimum drawdown amount, you can recontribute these amounts if you are eligible to make superannuation contributions (subject to other rules or limits such as contributions caps).

Tip!

Speak to your financial adviser before making any decisions affecting your super.

Tax time again!

The due date for lodging your income tax return for the 2024–25 income year is 31 October 2025. However, if you use a registered tax agent to lodge your return, the due date for lodgment is likely to be later than 31 October, possibly even as late as May next year.

Lodging a tax return

Are you a sole trader?

- Even if your income is below the tax-free threshold of $18,200, you still need to lodge a tax return.

- Do you pay PAYG instalments? Lodge your activity statements and pay all your PAYG instalments before you lodge your tax return so your income tax assessment takes into account the instalments you have paid throughout the year.

Are you a partnership?

If you operate your business in a partnership, the partnership lodges the partnership tax return, reporting the partnership’s net income or loss (assessable income less allowable deductions).

As an individual partner, you include in your individual tax return:

- your share of any partnership net income or loss;

- any other assessable income, such as salary and wages, dividends and rental income.

The partnership does not pay income tax on the income it earns. Instead, you and each of the partners pay tax on the share of net partnership income you receive.

Are you a trust?

- If you operate your business through a trust, the trust reports its net income or loss (this is the trust’s assessable income less allowable deductions).

- The trustee is required to lodge a trust tax return.

- If you are a beneficiary of the trust, you report on your individual tax return any income you receive from the trust.

Tip!

A registered tax agent can help you with your tax return.

Tax losses

A tax loss arises when the total deductions you can claim, excluding gifts, donations and personal superannuation contributions, are greater than your total income for an income year.

If you make a tax loss, you may be able to:

- offset the loss in the same income year against other assessable income; or

- carry forward the loss and claim it as a business deduction in a later income year.

Make sure you keep the correct records.

Tip!

Talk to your tax adviser about the best way to utilise tax losses and what records you should keep.

Non-commercial loss rules

If you are a sole trader or in a partnership and want to utilise a tax loss, first check if the business activity meets at least one of the commerciality tests under the non-commercial loss rules. (Those rules do not apply to losses made by primary producers and professional artists whose income from other sources is less than $40,000.)

If you meet at least one of the commerciality tests, then you can offset the loss against other assessable income (such as salary or investment income) in the same income year.

If you do not meet the commerciality tests, you can carry the loss forward to future income years. For example, you may be able to offset it when you next make a profit.

Non-commercial losses made by an individual with adjusted taxable income exceeding $250,000 are quarantined.

Tip!

The non-commercial loss rules are complicated. Talk to your tax adviser if you have any doubts about whether a business activity satisfies any of the commerciality tests.

Personal services income

If you operate your business through a company or a trust, income earned by the company or trust from the provision of your personal services (personal services income (PSI)) will be attributed to you unless:

- the company or trust is carrying on a personal services business (PSB); or

- the PSI was promptly paid to you as salary or wages.

The company or trust will be conducting a PSB if at least one of a number of tests are satisfied. These are the results test (the most important test), the unrelated clients test, the employment test and the business premises test.

If 80% or more of your PSI (with certain exceptions) is income from one client (or the client and their associate(s)) and the results test is not met, the company or trust will need to obtain a PSB determination from the ATO.

The company or trust cannot deduct amounts that relate to gaining or producing your PSI, unless you could have deducted the amount as an individual or the company or trust received the PSI in the course of conducting a PSB.

Even if you do not use a company or trust to derive your PSI, there are limitations on the deductions that you may claim against your PSI. For example, you may not be able to deduct certain home office expenses or occupancy expenses such as mortgage interest or rent.

Tip!

The PSI rules are complicated, especially if you provide your services through a company or trust. Talk to your tax adviser if you have any questions.

Car expenses

In order to claim a deduction for car expenses:

- you must own or lease the car;

- the expenses must be for work-related trips;

- you must have spent the money yourself and were not reimbursed; and

- you must have the required records.

Vehicles with a carrying capacity of one tonne or more, or 9 or more passengers (such as utes and panel vans) are not included in the definition of a car so these must be claimed separately as travel expenses.

You can claim trips directly between multiple workplaces or to perform your work duties, but you cannot claim trips between your home and place of work, except in limited circumstances.

Home office

If you operate your business from a home office, you can deduct the expenses of running that office. A home office is a room in your home that is used exclusively (or almost exclusively) for business activities.

Expenses you can claim a deduction for include:

- occupancy expenses — such as rent, mortgage interest, water rates, land taxes and house insurance premiums. Occupancy expenses are usually calculated by apportioning the expenses between the home office and the rest of the property on a floor area basis;

- running expenses — these are the increased costs from using your home for your business, including electricity or gas charges for heating, cooling and lighting, cleaning costs and the decline in value and the cost of repairs of deprecating assets such as furniture, furnishings and equipment; and

- work-related phone and internet expenses, including the decline in value of the handset. An apportionment will be required if the phone or computer is not used exclusively for work.

Other working from home expenses

If you work from home but do not have a home office as such, you can still claim deductions for what the ATO call ‘running expenses’.

To make it easier, the ATO allows a rate of 70 cents for each hour worked from home (the fixed rate method). Running expenses for these purposes are energy expenses, internet expenses, mobile and home phone usage expenses and stationery and computer consumables expenses (separate deductions need to be claimed for any other running expenses and depreciation on office equipment or furniture).

Of course, you can still claim based on your actual running expenses if it produces a larger deduction. But remember that those expenses will need to be apportioned between work and private use.

With the fixed rate method, you need to keep a record of the actual number of hours you worked from home for the whole financial year between 1 July and 30 June, and at least one record for each of the additional running expenses you incurred that the rate includes. You must also keep records for other running expenses you are claiming as a separate deduction that the rate doesn’t include.

To show your actual hours worked, this can be as simple as a timesheet, spreadsheet, diary or a record where you log which days you work from home and how many hours you worked.

Tip!

If you work from home, whether or not you have a home office, talk to your tax adviser about what you can deduct and the records you must keep.

From the ATO

Apportioning rental interest expenses

If you own a rental property and it is mortgaged, you can deduct the interest paid on the mortgage (but not repayments of the principal). However, you will need to apportion interest expenses where:

- you co-own the property, unless a separate legally enforceable written agreement is in place stating, for example, that you are 100% liable for the loan repayments, interest and expenses;

- you increase the mortgage on the property for private purposes;

- you use the property for private purposes, even if it is for only a short period of time;

- you have included private items in your rental property loan or refinanced or drawn down on the loan for private purposes; or

- the property is rented out for only part of the year.

If you are renting out part of your main residence, for example a single room, you must apportion the interest expense according to the time and space dedicated to income producing activities.

If you sold your property part way through the year or have changed its purpose (for example, moved into the rental property), interest on the mortgage must be apportioned according to the period the property was rented out.

Tips to get the main residence exemption right

The ATO is seeing issues with non-reporting of capital gain and losses, and the main residence exemption (MRE), when properties are sold. Here is a checklist.

- If you have bought or disposed of property, are you using or have you used the property solely as your main residence or earning or earnt income from it (rental or business)?

- Have you disposed of vacant land? If you dispose of vacant land, you are not eligible for the MRE, even if you intended to build your main residence on it.

- Can you use the 6-year absence rule? This rule can be used only if the property was your main residence before you rented it out and it ceases to be your main residence. If you choose to use this rule, make the election by including the MRE in the CGT section of your tax return.

- Did you own more than one property during any of the ownership period of the property you sold? You can claim the MRE for only one property at a time. The only exception is the 6-month period when you move from one home to another.

- Has your Australian tax residency changed while owning the property? It may affect your eligibility for the MRE.

- Are you keeping the correct records?

Tip!

Talk to your tax adviser if you are using your main residence to produce income.

Remember tax if leaving a professional services partnership

Individual professional practitioners must meet their tax obligations when exiting or retiring from a partnership.

If you are an individual professional practitioner (IPP), you must record, as assessable income in your individual tax return, any assessable distributions derived during an income year that are related to the net income of your partnership.

As a former partner in a professional services firm, your tax obligations do not end when your role in the partnership finishes. A range of common reporting issues among retired or exited partners can lead to compliance risks if not addressed early.

Omissions of final partnership income or distributions

Many partnership agreements continue to pay the IPP for a set period after they leave the firm. These payments are considered assessable income in the income year from which they are derived. The ATO is concerned that former partners incorrectly report these distributions as capital and not income or, in some cases, omit the amounts completely.

You can still receive assessable partnership distributions after retiring or exiting the partnership, depending on the governing documents and agreements for your firm.

Incorrect treatment of retirement payments or deferred entitlements

The ATO is seeing that some retired partners do not understand their partnership agreement, or their final partnership statements, and are incorrectly categorising these distributions as ‘pension’ type payments. Based on the arrangements identified to date, these distributions are the allocation of profits or income from professional firms and must be reported as assessable income by the IPP.

Misreporting of capital account adjustments

The capital account measures the partner’s equity investment in the partnership and may hold shares or other investments. Changes to a capital account may result in losses. However, not all losses will be deductible or give rise to a capital loss.

Accurate record keeping and reporting is essential to determine whether losses can be applied only against current or future year capital gains and whether any gains may be eligible for the capital gains tax discount.

Overlooking of obligations related to service trusts or related entities

While service arrangements may vary widely in the precise steps used, in essence they involve a taxpayer incurring a deduction for fees and charges in the conduct of its business for the acquisition of staff, clerical and administrative services, premises, plant or equipment from an associated entity. These arrangements are sometimes called ‘Phillips arrangements’. The ATO’s concerns are detailed in Taxation Ruling TR 2006/2 (Income tax: deductibility of service fees paid to associated service entities: Phillips arrangements).

If you are planning to leave, or have recently left, a professional firm

If you are planning to leave, or have recently left, a professional firm, the ATO recommends that you:

- review your agreement and final statements;

- seek advice early from a tax professional who is familiar with professional firm structures;

- use updated guidance from the ATO, or your firm’s finance team;

- keep records of all communications and payments post-exit;

- accurately report all income and distributions received – this includes all income derived, including amounts that may not be physically received but are applied or dealt with on your behalf;

- include any capital gains or adjustments related to your exit; and

- ensure retirement payments are correctly classified.

If you are still uncertain about to how to treat payments, you may seek a private ruling from the ATO in relation to your circumstances.

Private rulings

A private ruling is binding advice that sets out how a tax law applies to you in relation to a specific scheme or circumstance.

A private ruling can cover anything involved in the application of a relevant provision of a tax law, including issues relating to:

- liability;

- administration;

- procedure and collection; and

- ultimate conclusions of fact (such as residency status).

If you would like to discuss your issue with the ATO prior to applying for a private ruling, you can submit an Early engagement for advice request.

General anti-avoidance rules

Part IVA of the Income Tax Assessment Act 1936 (Part IVA) is a general anti-avoidance rule that can apply in certain circumstances. If Part IVA applies to an arrangement, the tax benefits you obtained from the arrangement can be cancelled — for example, the ATO might disallow a deduction that would otherwise be allowable.

When you apply for a private ruling about an arrangement, you can also ask the ATO to consider whether Part IVA applies to the arrangement. If you do not ask the ATO to provide a ruling on the application of Part IVA, it is still required to consider its application where the information provided in your ruling request indicates that it could apply.

If you apply for a private ruling on Part IVA, you need to provide detailed information regarding your arrangement, including transaction documents, contracts and information to support your commercial rationale and circumstances. You will need to provide sufficient information to enable the ATO to fully understand the commercial and tax consequences of that arrangement. If there is insufficient information to determine whether Part IVA applies, it may not be possible to develop the necessary set of facts and circumstances upon which a ruling can be made.

If the ruling requested concerns a prospective arrangement, details of the exact circumstances and the implementation of the arrangement (that is, how the proposal is actually carried out) may not be ascertainable.

While assumptions can be made in limited instances, the ATO must be comfortable that such assumptions are appropriate and can be reliably made.

If you ask the ATO to provide a ruling about the application of Part IVA, you may also ask the ATO to refer the Part IVA matter for consideration by the General Anti-Avoidance Rules Panel (GAAR Panel). You may request a referral to the panel either with your ruling application, or after you have lodged your application.

Refusal to make a ruling

The ATO may decline to make a ruling where:

- details of the arrangement relevant to determining whether Part IVA applies are incomplete or information to support those details is not available; or

- the correctness of the ruling would depend on which assumptions about a future event or other matter were made.

Operation Protego convictions

Operation Protego is an ATO-led investigation into large-scale GST fraud that was promoted particularly on social media. The attempted fraud involves an individual:

- inventing a fake business;

- lodging a fraudulent Australian business number (ABN) application; and

- submitting fictitious business activity statements (BAS) to attempt to gain a false GST refund.

Recent convictions arising from Operation Protego include:

- Ms SL was sentenced to 3.5 years imprisonment for 14 counts of obtaining a financial advantage by deception and a further 2 years imprisonment for 3 counts of attempting to obtain a financial advantage by deception (the sentences are to be served concurrently, with a non-parole period of 12 months). Ms SL obtained an ABN, claiming she was providing beauty services or a salon operation business. Between October 2021 and May 2022, she lodged 17 fictitious BASs, dishonestly receiving over $269,000 in GST refunds and attempting to obtain a further $86,331.

- Ms JP was sentenced to 22 months jail for 8 counts of obtaining a financial advantage by deception and one count of attempting to obtain a financial advantage by deception, although she was to be released immediately on a recognisance release order to be of good behaviour for 2 years. In August 2021, Ms JP registered for an ABN for a Dental Laboratory. Over the following months, she lodged 9 BASs and dishonestly obtained over $230,000 in GST refunds and attempted to obtain a further $49,947.

- Mr BN was sentenced to 18 months jail after being charged with 3 counts of dishonestly obtaining a gain from the Commissioner of Taxation. He is to be released immediately on the condition that he be of good behaviour for 2 years. In February 2022, Mr BN registered for an ABN, claiming to be a sole trader providing ‘lawn mowing or care’ services. Over the next 4 months, a total of 6 false BASs were lodged in his name.

- Ms SO has been sentenced to 18 months jail on one count of obtaining a financial advantage by deception and one count of attempting to obtain a financial advantage by deception. She will be released after serving 6 months in custody, on the condition that she be of good behaviour for 2 years. Ms SO registered an ABN for a party planning business that was direct selling beauty products. From October 2021, and over the following 8 months, she submitted 15 fictitious BASs, claiming $139,834 in GST refunds to which she was not entitled.

In all cases, the convicted persons were ordered to repay the amounts falsely claimed.

Do you have an SMSF?

Verifying ownership and asset separation during SMSF audit

When conducting the annual self-managed superannuation fund (SMSF) audit, auditors must gather sufficient evidence to confirm that:

- the fund owns its reported assets (Part A of the SMSF Independent Auditor’s Report); and

- the trustees comply with the asset separation rules (Part B of the SMSF Independent Auditor’s Report).

Trustees are required to keep fund assets and money separate from their personal assets, as well as from those held by any standard employer sponsor or their associates. This rule protects fund assets in case of creditor disputes.

Failing to maintain separation of assets results in a contravention of the rules.

If the reporting criteria is met, the auditor must also report a contravention in an Auditor/actuary contravention report (ACR). This may occur when a company acts as both the SMSF trustee and a business operator and uses the same bank account for both SMSF and business income.

Protect your SMSF’s bank account

Trustees must remain vigilant when managing the SMSF bank account.

Only authorised parties should have access to the SMSF’s bank account. Trustees must understand to whom they are providing access and regularly check who has access.

If you are a trustee, you are responsible for protecting your fund’s assets, and giving access to the wrong person can lead to financial loss and compliance issues.

The ATO has seen a rise in instances where SMSFs have failed to notify the ATO of changes to the fund’s bank account. If the SMSF’s bank account changes, you must notify the ATO immediately. Not doing so can delay or prevent rollovers and other important transactions.

To meet your obligations, once you set up a bank account that is unique to your SMSF or if you change account details, you must notify the ATO either:

- through your registered agent;

- through Online services for business via the Profile menu; or

- by phoning the ATO on 13 10 20.

If your SMSF does not have a unique bank account, then your member’s retirement benefits may not be protected.

It’s essential to keep fund money and assets separate from personal or related-party assets.

Your SMSF’s account should only be used to accept contributions, receive investment income and pay fund expenses.

If you suspect someone has been added to your accounts without your authority or notice suspicious account transactions made by a third party without your consent, contact your bank immediately.

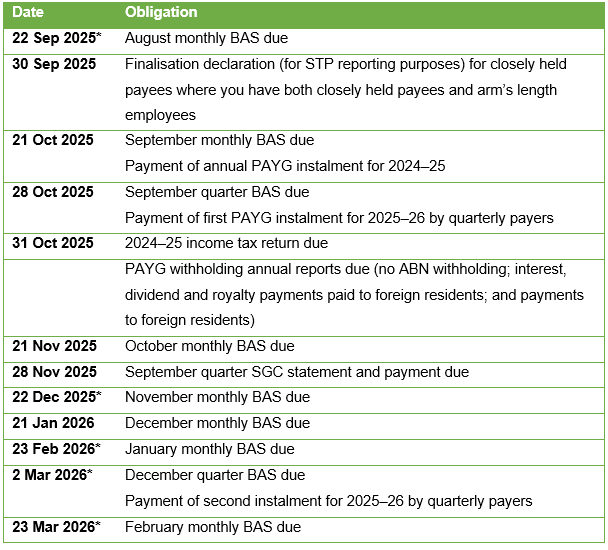

Key tax dates

*This is the next business day as the due date falls on a Saturday or Sunday.

Note!

Talk to your tax agent to confirm the correct due dates for your own tax obligations. For example, you may have more time to lodge and pay if impacted by a natural disaster.

DISCLAIMER

TaxWise® News is distributed by professional tax practitioners to provide information of general interest to their clients. This document does not take into account the specific circumstances of any person and does not constitute professional advice. Readers should not rely on the information contained in this document as advice for any matter, but should make their own assessment and evaluation, undertake investigation and enquiries and seek professional advice to enable them to make any decision concerning their own interests.